Edit Employee Wages

The Edit Employee Wages feature allows the Employer to modify information pertaining to a particular employee.

Steps to follow:

1. Enter the credentials to access the Portal.

2. Select the Income Tax tab. A general description of the service will appear.

3. Select the Wage Statement (Payroll) option.

4. Select the year and tax quarter desired. The Edit Payroll screen will then be displayed.

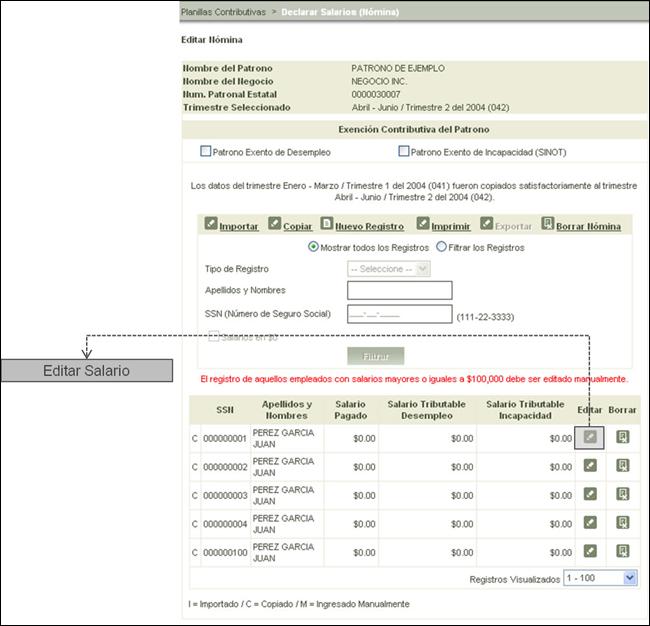

Figure 25:

Edit Employee Wages

Figure 25:

Edit Employee Wages

5.

Select the  button to view the Edit

Wages screen.

button to view the Edit

Wages screen.

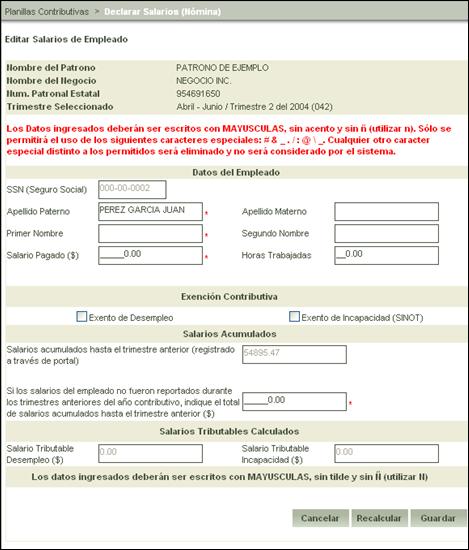

Figure 26: Edit Employee Wages

6. Modify the registered information as needed.

The screen is divided into four (4) sections:

1) Employee Information

2) Income Tax Exemption

3) Accumulated Wages

4) Calculated Paid Wages

Employee Information

The Employee Information section contains the following fields:

• Paternal Last Name

• Mother’s Maiden Name

• First Name

• Middle Name

• Wages Paid

• Hours Worked

The information may be modified according to the Employer’s needs as well as completing the required fields (those marked with an *).

Income Tax Exemption

The Income Tax Exemption section is comprised of the following fields:

• Unemployment Exemption; and

• Disability Exemption.

Each of these fields may be selected separately, in this way allowing for the configuration of particular exemptions for each of the employees.

Accumulated Wages

The Accumulated Wages section contains two (2) fields. The first field indicates what the accumulated wages filed for an employee for previous quarters were. The second field allows for the modification of that value in order to execute the Paid Wages calculation.

Important:

This

feature should be used in the event a quarter’s corresponding electronic file

was not executed. Enter the correct accumulated wages into the second field and

select the Recalculate  button to view

the paid wages to be used in the calculation.

button to view

the paid wages to be used in the calculation.

Calculated Paid Wages

The Calculated Paid Wages section contains two (2)

fields. The first field indicates the paid unemployment wages. The second field

indicates the paid disability wages. Both fields change upon selecting the

Recalculate  button when a new

accumulated wage is entered.

button when a new

accumulated wage is entered.