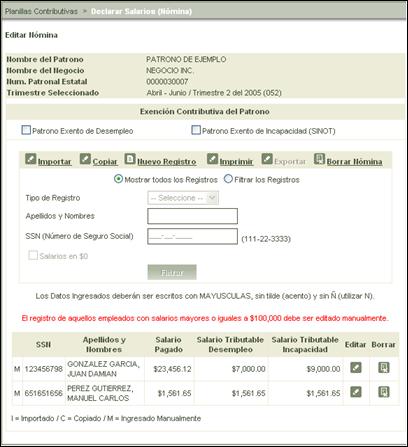

Edit Payroll

The Edit Payroll feature allows the user to:

• View the employer information and the quarter being worked with;

• Indicate the income tax exemption for the entire payroll. If the tax exemption only applies to some of the employees, the user must then indicate each employee separately (as demonstrated in the New Register and Edit Employee Wages section further on);

•

Filter the payroll according to the subsequent fields. For this select

the Filter Registries option which will

enable the fields to be used in order to complete this task.

option which will

enable the fields to be used in order to complete this task.

Figure 2: Edit Payroll Filter

Select all or none of the filters

and click on the Filter button to view a

payroll applicable to your needs.

button to view a

payroll applicable to your needs.

Note: To view all of the

registries, select the View All Registries  option.

option.

• View the payroll containing the following information:

o Type of Register:

§ Imported (I)

§ Copied (C)

§ Manually Entered (M)

o SSN: Social Security Number

o First and Last Name

o Paid Wages

o Paid Unemployment Wages

o Paid Disability Wages

o Edit:  Will direct the user to the Edit Employee

Wages screen

Will direct the user to the Edit Employee

Wages screen

o Delete:  By selecting this button the application

will request that the user confirm the removal of the register by way of the

following message:

By selecting this button the application

will request that the user confirm the removal of the register by way of the

following message:

Figure 3: Delete Register

• Allows the user to access the following features:

o Import:

o Copy:

o New Register:

o Print:

o Export:

o Delete Payroll:

Figure 4: Edit Payroll