File Quarter

The File Quarter feature allows the user to file a registered payroll for a particular quarter.

Note: Once the payroll has been filed no further changes can be made to it.

Filing quarters consists of four (4) steps:

1. Select the quarter to be filed;

2. Enter the number of employees;

3. Accept the Terms and Conditions to file the income tax; and

4.

Obtain the confirmation of the transaction performed.

Figure 27: File Quarter Steps

Steps to follow:

1. Enter the credentials to access the Portal.

2. Select the Quarter tab. A general description of the service will appear.

3. Select the File Quarter option.

Figure 28: Select Quarter

4. Select the quarter to be filed. As with the rest of the application, the user may navigate through the different years by selecting a tax year.

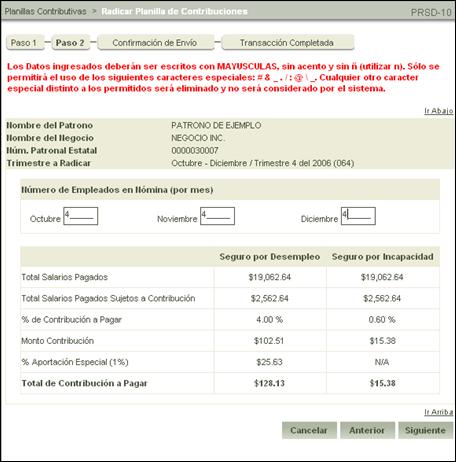

Figure 29: Income Tax Information

5. Enter

the number of employees for each month and select the  button.

button.

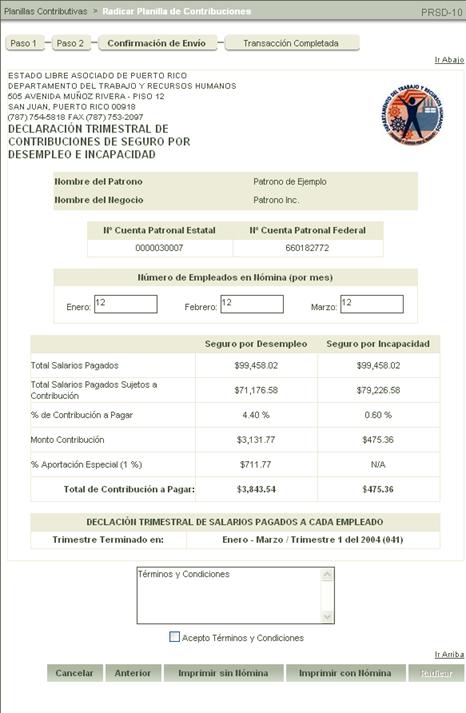

Figure 30: Remittance Confirmation

6. Verify the payroll being filed.

If the information is correct, accept the Terms and Conditions in order to proceed filing the income tax statement. In the event the information is incorrect and the user does not accept the Terms and Conditions, the application will not proceed to file.

Figure 31: File Income Tax

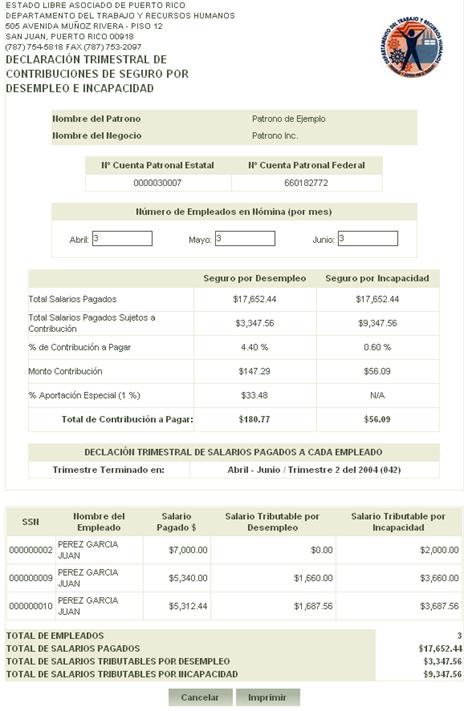

The File Income Tax feature allows the user to print the tax statement being filed in two (2) ways:

•

The

statement can be printed without employee wages by selecting the Print without

Payroll  button.

button.

Figure 32: Print without Payroll

•

The

statement can also be printed with the employee payroll by selecting the Print

with Payroll  button.

button.

Figure 33: Print with Payroll

7. After filing the Income Tax statement, a confirmation of the transaction performed can be obtained as made evident in the following image:

Figure 34: Filed Income Tax Confirmation